Delving into the realm of Simplified Life Insurance Application Process Explained, this guide offers a detailed exploration of the topic, shedding light on its significance and impact in the insurance industry.

As we navigate through the intricacies of this streamlined process, we uncover key insights that demystify the complexities of life insurance applications.

Overview of Simplified Life Insurance Application Process

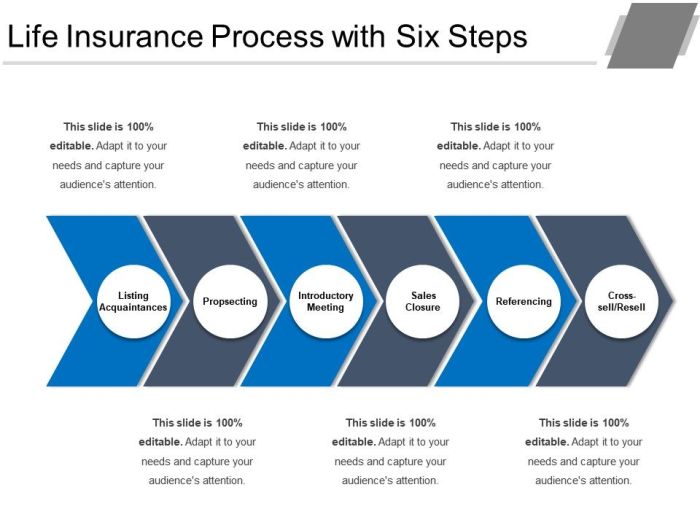

When it comes to applying for life insurance, the traditional process can often be lengthy and overwhelming. However, a simplified life insurance application process aims to streamline and expedite the application process for both insurers and applicants.

Differences from Traditional Applications

- Minimal paperwork: Simplified applications typically require less documentation compared to traditional applications, making the process quicker and more convenient.

- No medical exams: In many cases, simplified applications do not require applicants to undergo medical exams, eliminating a significant barrier to obtaining coverage.

- Faster approval: With fewer requirements and faster underwriting processes, simplified applications can lead to quicker approval decisions.

Benefits for Insurers and Applicants

- For insurers: Streamlining the application process reduces administrative costs, speeds up policy issuance, and attracts a broader customer base.

- For applicants: The simplified process saves time, eliminates the need for intrusive medical exams, and provides faster access to life insurance coverage.

Key Features of a Simplified Life Insurance Application

Life insurance companies have been implementing various features to simplify the application process for customers. These features aim to streamline the process, reduce paperwork, and provide a more efficient and convenient experience compared to traditional applications.

1. Online Application Process

- Customers can complete the entire application process online, from filling out forms to submitting documents.

- Eliminates the need for in-person meetings or paper applications, saving time and reducing hassle for applicants.

- Companies like Lemonade and Fabric offer fully digital platforms for life insurance applications.

2. Simplified Underwriting

- Utilization of automated underwriting systems to assess risk and determine eligibility quickly.

- May involve asking fewer medical questions or using data analytics to evaluate applicants' health profiles.

- Companies like Ladder and Bestow use simplified underwriting processes to expedite approvals.

3. Instant Coverage Decisions

- Some companies provide instant coverage decisions based on the information provided in the application.

- Applicants can receive immediate approval or denial, offering transparency and efficiency.

- Insurtech companies such as Ethos and Sproutt offer real-time decisions for life insurance coverage.

Technology Integration in Simplifying Life Insurance Applications

Technology plays a crucial role in simplifying the life insurance application process, making it more efficient and accurate. By leveraging various digital tools, automation, and artificial intelligence, insurance companies are able to streamline the application process for their customers.

Role of AI in Application Processing

Artificial intelligence is utilized in the life insurance application process to automate tasks such as data collection, risk assessment, and underwriting. AI algorithms can analyze vast amounts of data quickly and accurately, providing insurers with valuable insights to make informed decisions.

Automation in Application Processing

- Automated workflows help in speeding up the application process by reducing manual tasks and paperwork.

- Chatbots and virtual assistants are used to provide instant support to applicants and answer their queries efficiently.

- Automated underwriting processes help in assessing risk and determining premiums more quickly and accurately.

Digital Tools for Efficiency and Accuracy

- Online portals and mobile apps allow applicants to submit documents and complete forms digitally, eliminating the need for physical paperwork.

- E-signature capabilities enable applicants to sign documents electronically, making the process more convenient and faster.

- Data analytics tools help in analyzing customer information and behavior to personalize insurance offerings and improve customer experience.

Customer Experience in a Simplified Life Insurance Application

When it comes to life insurance, the customer experience is crucial in ensuring a smooth and hassle-free application process. A simplified application process can significantly enhance the overall customer experience by making it more user-friendly and intuitive. Here are some tips on designing a user-friendly and intuitive application interface to improve customer satisfaction:

Designing a User-Friendly Interface

- Keep the application process simple and easy to navigate, with clear instructions at each step.

- Use a clean and uncluttered layout to avoid overwhelming the applicant with too much information.

- Include progress indicators to show applicants how far along they are in the application process.

- Offer help options such as live chat support or a customer service hotline for any questions or concerns.

Personalization and Customization

- Allow applicants to customize their coverage options to meet their specific needs and budget.

- Personalize the application process by pre-filling information where possible based on data provided by the applicant.

- Provide recommendations or suggestions based on the applicant's profile to help them make informed decisions.

- Offer a variety of communication channels for applicants to choose from, such as email, phone calls, or text messages.

Summary

In conclusion, the Simplified Life Insurance Application Process stands as a beacon of efficiency and convenience in an otherwise daunting landscape, revolutionizing how individuals secure their financial futures with ease.

Common Queries

What makes a life insurance application process simplified?

A simplified life insurance application process involves streamlined procedures and minimal documentation requirements, making it quicker and more accessible for applicants.

How does technology enhance the efficiency of life insurance applications?

Technology such as AI and automation simplifies the process by speeding up application processing, reducing errors, and improving overall accuracy.

Why is customer experience important in a simplified life insurance application?

Enhancing customer experience ensures that applicants have a seamless and user-friendly journey, leading to higher satisfaction levels and increased trust in the insurance provider.