How to Compare Life Insurance Quotes Without Hidden Fees sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with a casual formal language style and brimming with originality from the outset.

Understanding the components of life insurance quotes, researching insurance providers, comparing coverage options, analyzing costs and fees, and seeking professional guidance are all crucial steps in navigating the complex world of life insurance without hidden fees.

Understanding Life Insurance Quotes

When looking at life insurance quotes, it's essential to understand the components that make up the quote and the key factors to consider when comparing different options. Additionally, reading the fine print is crucial to uncover any hidden fees that may impact the overall cost and coverage of the policy.

Components of a Life Insurance Quote

- The premium: This is the amount you pay periodically (monthly, quarterly, annually) to maintain the policy.

- The coverage amount: This is the sum of money that will be paid out to your beneficiaries upon your death.

- The term or duration of the policy: This is how long the policy will stay in effect before it needs to be renewed or expires.

- Additional riders or options: These are optional features you can add to customize your policy, such as accelerated death benefits or accidental death coverage.

Key Factors to Consider When Comparing Quotes

- Cost: Compare premiums from different providers to ensure you are getting a competitive price for the coverage you need.

- Coverage: Make sure the policy offers the amount of coverage you require to protect your loved ones financially.

- Term: Consider the duration of the policy and whether it aligns with your long-term financial goals and needs.

- Riders: Evaluate any additional options or riders offered by each provider to see if they enhance the overall value of the policy.

Remember, the cheapest quote may not always be the best option if it doesn't provide adequate coverage or includes hidden fees.

Researching Insurance Providers

When comparing life insurance quotes, it is crucial to research the insurance providers offering these policies. Understanding the reputation and financial stability of an insurer can help you make an informed decision and avoid hidden fees in the future.

Evaluating Reputation and Financial Stability

- Check customer reviews and ratings online to gauge the satisfaction level of policyholders.

- Look into the insurer's history of claim settlements and customer service responsiveness.

- Verify the financial strength rating of the company from reputable agencies like AM Best or Standard & Poor's.

- Consider the number of years the insurer has been in business and their track record of stability.

Comparing Coverage Options

When comparing life insurance quotes, it is essential to consider the different coverage options available to ensure you choose the right policy for your needs. Understanding the types of coverage and how they can impact the overall cost of the policy is crucial in making an informed decision.

Types of Life Insurance Coverage

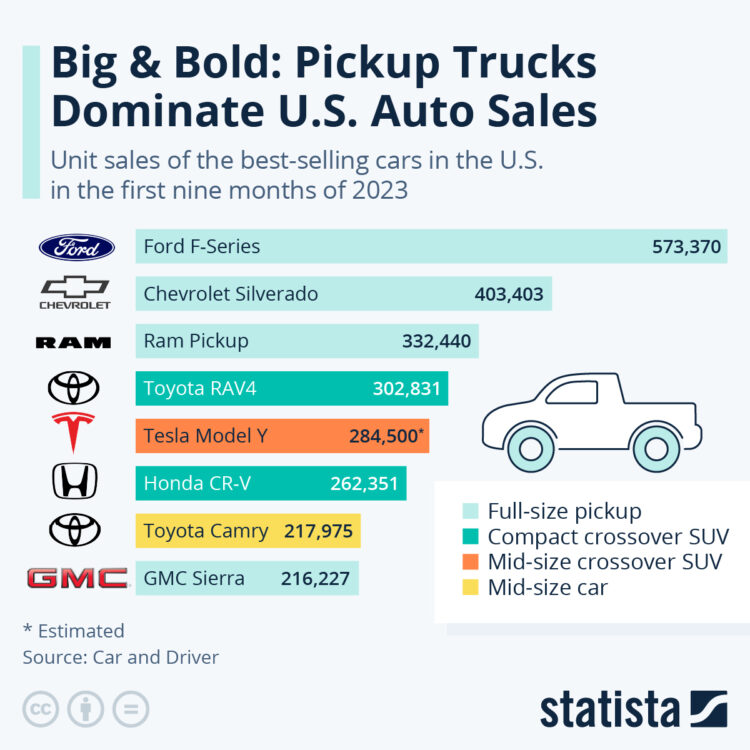

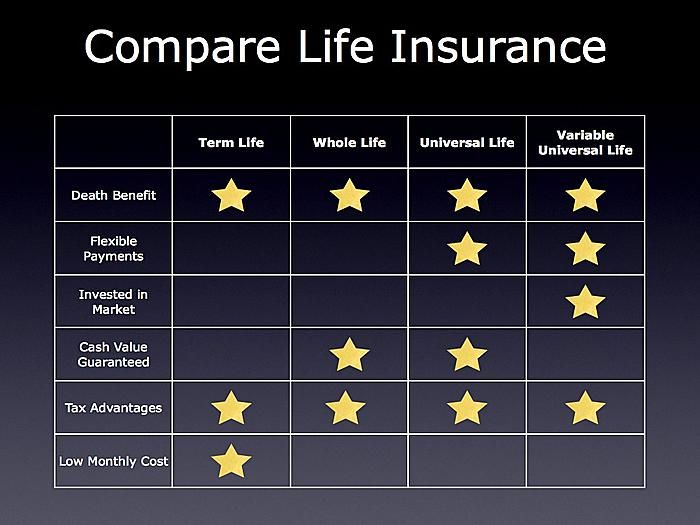

- Term Life Insurance: Provides coverage for a specific period, such as 10, 20, or 30 years. It offers a death benefit to beneficiaries if the policyholder passes away during the term.

- Whole Life Insurance: Offers coverage for the entire life of the policyholder. It includes a cash value component that grows over time and can be used for loans or withdrawals.

- Universal Life Insurance: Combines a death benefit with a savings component that earns interest over time. It provides flexibility in premium payments and death benefits.

- Variable Life Insurance: Allows policyholders to invest the cash value portion in various investment options, such as stocks or bonds. The death benefit and cash value can fluctuate based on investment performance.

Term Life Insurance vs. Whole Life Insurance

- Term Life Insurance is typically more affordable than Whole Life Insurance because it does not include a cash value component.

- Whole Life Insurance offers lifetime coverage and the ability to build cash value over time, but it tends to have higher premiums.

- Term Life Insurance is well-suited for those looking for temporary coverage, while Whole Life Insurance provides long-term protection and investment potential.

It is important to assess your financial goals and needs to determine which type of life insurance coverage is the most suitable for you.

Analyzing Cost and Fees

When comparing life insurance quotes, it's crucial to analyze the costs and fees associated with each policy. This involves looking at premiums, deductibles, and any hidden fees that may impact the overall cost of the policy.

Comparing Premiums and Deductibles

- Look at the monthly or annual premiums for each insurance quote to determine the cost of the policy over time.

- Consider the deductible amount, which is the out-of-pocket expense you must pay before the insurance coverage kicks in.

- Compare how premiums and deductibles vary across different quotes to find the most cost-effective option.

Common Hidden Fees in Life Insurance Policies

- Policy fees: Some insurance companies charge additional fees for policy administration or processing.

- Rider fees: Adding extra coverage options, known as riders, can come with additional fees.

- Surrender charges: If you cancel the policy early, you may face surrender charges, reducing your payout.

- Underwriting fees: Fees for the insurance company to assess your risk and determine your premium.

- Policy loan interest: If you borrow against the cash value of your policy, there may be interest charges.

Identifying and Avoiding Hidden Fees

- Read the policy documents carefully to understand all fees associated with the insurance policy.

- Ask your insurance agent or provider to explain any fees that are unclear to ensure transparency.

- Compare the total cost of each policy, including all fees, to accurately assess the best value.

- Consider working with a reputable insurance provider with a history of transparent pricing and minimal hidden fees.

Seeking Professional Guidance

When navigating the complex world of life insurance, seeking professional guidance from an insurance agent or financial advisor can be incredibly beneficial.

These experts have a deep understanding of the insurance industry and can help you make sense of the various quotes and policies available to you. They can provide personalized recommendations based on your unique needs and financial situation, ensuring that you select the most suitable coverage.

Benefits of Consulting with an Insurance Agent or Financial Advisor

- Expertise: Insurance agents and financial advisors have in-depth knowledge of the insurance market and can help you navigate through complex policy details.

- Personalized Recommendations: Professionals can assess your individual needs and recommend coverage options that best align with your financial goals and circumstances.

- Clarifying Hidden Fees: Experts can help you uncover any hidden fees or clauses within insurance policies that may not be immediately apparent when comparing quotes on your own.

Conclusion

In conclusion, mastering the art of comparing life insurance quotes without hidden fees can save you money and provide peace of mind. By understanding the nuances of policies, researching providers, comparing coverage options, and seeking expert advice, you can secure the best possible deal for your needs.

FAQ Section

What are the key factors to consider when comparing life insurance quotes?

When comparing life insurance quotes, consider the coverage amount, type of policy, premiums, deductibles, and any hidden fees that may impact the overall cost.

How can I identify hidden fees in life insurance policies?

To identify hidden fees in life insurance policies, carefully read the fine print, look for charges like policy fees, administrative fees, or surrender charges, and ask the insurer directly about any potential additional costs.

Why is it important to choose a reliable insurer when comparing life insurance quotes?

Choosing a reliable insurer is crucial to avoid hidden fees and ensure that your policy will be honored when needed. A financially stable and reputable insurer is less likely to impose unexpected charges or deny legitimate claims.