As we look ahead to 2025, Affordable Life Insurance Plans for Retirees take center stage in ensuring financial security during retirement. This topic delves into the nuances of life insurance tailored for retirees, highlighting the importance of affordability and proper planning.

Join us on this insightful journey as we explore trends, factors, and tips for selecting the right life insurance plan in the upcoming years.

Introduction to Affordable Life Insurance Plans for Retirees in 2025

Life insurance for retirees refers to a financial product designed to provide a death benefit to beneficiaries upon the death of the policyholder after retirement. It serves as a safety net to ensure financial security for loved ones in the event of the policyholder's passing.Affordable life insurance is crucial for retirees as it helps cover final expenses, outstanding debts, and provides a source of income replacement for surviving family members.

With the rising cost of healthcare and funeral expenses, having a reliable life insurance plan can alleviate financial burdens during a difficult time.Planning for life insurance in retirement is essential to guarantee that loved ones are financially protected after the policyholder's death.

It offers peace of mind knowing that beneficiaries will have the necessary funds to cover expenses and maintain their quality of life.

The Importance of Affordable Life Insurance for Retirees

- Ensures financial security for loved ones: Life insurance provides a tax-free lump sum payment to beneficiaries, offering financial stability after the policyholder's passing.

- Covers final expenses: From funeral costs to outstanding debts, life insurance can help cover these expenses without burdening surviving family members.

- Income replacement: For retirees with dependents, life insurance can replace lost income and ensure beneficiaries can maintain their standard of living.

- Peace of mind: Knowing that loved ones are financially protected can bring peace of mind to retirees, allowing them to enjoy their retirement without worry.

Trends in Life Insurance for Retirees in 2025

Life insurance for retirees in 2025 is witnessing significant trends that reflect the changing needs and preferences of this demographic. As retirees look for financial security and peace of mind in their retirement years, the insurance industry is evolving to meet these demands.

Let's explore some of the key trends shaping the life insurance market for retirees and how the industry is adapting to cater to their specific needs.

Personalized Retirement Plans

In 2025, life insurance companies are increasingly offering personalized retirement plans tailored to the individual needs and preferences of retirees. These plans take into account factors such as health conditions, financial goals, and lifestyle choices to provide customized coverage that aligns with retirees' unique circumstances.

By offering personalized solutions, insurance companies are ensuring that retirees have access to comprehensive coverage that meets their specific requirements.

Long-Term Care Coverage

Another trend in life insurance for retirees is the inclusion of long-term care coverage in insurance policies. With the rising costs of healthcare and the increasing need for long-term care services as retirees age, insurance companies are introducing products that combine life insurance with long-term care benefits.

This innovative approach provides retirees with financial protection against medical expenses and long-term care services, offering them greater peace of mind during their retirement years.

Digital Transformation

In 2025, the insurance industry is undergoing a digital transformation to enhance the customer experience for retirees. From online policy management to digital claims processing, insurance companies are leveraging technology to streamline processes and improve access to services for retirees.

This shift towards digitalization not only makes it easier for retirees to manage their life insurance policies but also enables insurance companies to deliver more efficient and personalized services to their customers.

Innovative Investment Options

Life insurance products for retirees in 2025 are incorporating innovative investment options to help retirees grow their savings and secure their financial future. These products may include features such as indexed universal life insurance, which offers the potential for cash value growth based on the performance of a stock market index.

By providing retirees with access to diversified investment opportunities within their life insurance policies, insurance companies are empowering them to build wealth and achieve their retirement goals more effectively.

Factors Affecting Affordable Life Insurance for Retirees in 2025

When it comes to affordable life insurance for retirees in 2025, several key factors play a significant role in determining the cost and availability of coverage.

Health Conditions Impact

Health conditions have a direct impact on the affordability of life insurance for retirees. Insurers assess the health status of individuals to determine the level of risk they pose. Retirees with pre-existing health conditions may face higher premiums or even be denied coverage altogether.

Conditions such as heart disease, diabetes, or cancer can significantly increase the cost of life insurance.

Lifestyle Choices Influence Premiums

Lifestyle choices also play a crucial role in the pricing of life insurance plans for retirees. Factors such as smoking, alcohol consumption, and participation in high-risk activities can lead to higher premiums. Insurers consider these lifestyle choices as potential indicators of increased risk, which translates to higher costs for coverage.

Retirees who maintain a healthy lifestyle may benefit from more affordable life insurance options.

Types of Affordable Life Insurance Plans for Retirees in 2025

Life insurance is a crucial financial tool for retirees to secure their future and provide for their loved ones. In 2025, there are several types of affordable life insurance plans available that cater to the specific needs of retirees. Let's delve into the key options retirees can consider:

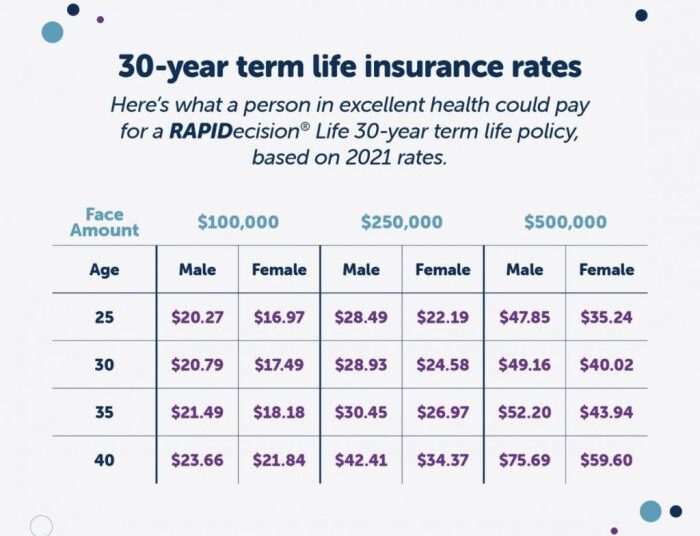

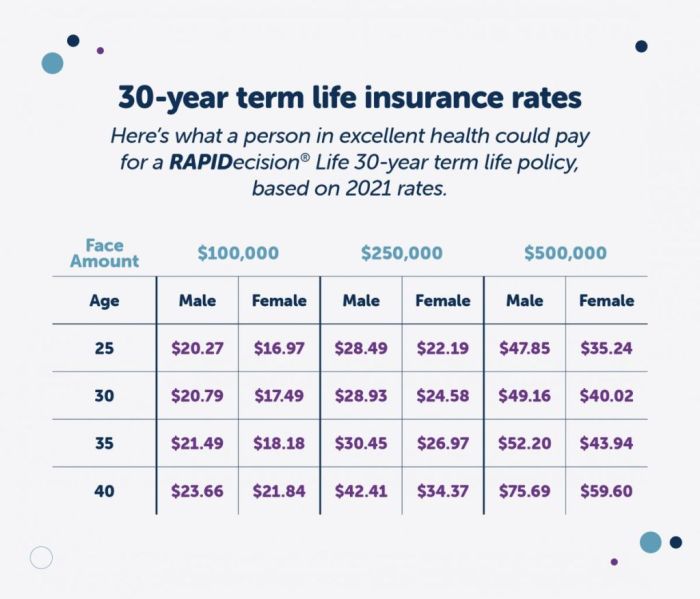

Term Life Insurance vs. Whole Life Insurance

Term life insurance and whole life insurance are two primary types of life insurance that retirees can choose from. Here is a comparison of the two:

- Term Life Insurance:

- Provides coverage for a specific term, such as 10, 20, or 30 years.

- Generally more affordable than whole life insurance.

- Offers a death benefit to beneficiaries if the policyholder passes away during the term.

- Does not accumulate cash value.

- Whole Life Insurance:

- Provides coverage for the entire life of the policyholder.

- Offers a death benefit and cash value accumulation over time.

- Premiums are typically higher compared to term life insurance.

- Can be used as an investment vehicle due to cash value growth.

Benefits of Guaranteed Universal Life Insurance

Guaranteed universal life insurance is a type of permanent life insurance that offers several benefits for retirees:

- Provides lifelong coverage with guaranteed premiums.

- Offers flexibility in premium payments and death benefit options.

- Accumulates cash value over time that can be accessed tax-free.

- Ensures financial security for retirees and their beneficiaries.

Suitability of Indexed Universal Life Insurance

Indexed universal life insurance is another option for retirees looking for affordable coverage with potential cash value growth:

- Links cash value growth to the performance of stock market indexes.

- Offers downside protection with a guaranteed minimum interest rate.

- Provides flexibility in premium payments and death benefit adjustments.

- Can be a suitable option for retirees seeking higher growth potential with some level of risk.

Tips for Choosing the Right Life Insurance Plan in 2025

When it comes to selecting the best life insurance plan as a retiree in 2025, there are several key factors to consider to ensure you make the right choice for your needs and circumstances.

Consider Your Beneficiaries

- Identify who your beneficiaries will be: Whether it's your spouse, children, or other loved ones, knowing who will receive the benefits of your life insurance policy is crucial.

- Consider their financial needs: Take into account the financial obligations and goals of your beneficiaries to determine the coverage amount that would best support them in the event of your passing.

- Review and update beneficiaries regularly: Life circumstances change, so it's important to review and update your beneficiaries as needed to ensure your life insurance plan aligns with your current situation.

Customize Your Life Insurance Plan

- Assess your financial situation: Understand your financial needs and capabilities to determine the type and amount of coverage that is suitable for you.

- Consider additional riders: Explore optional riders that can enhance your life insurance coverage, such as critical illness or long-term care riders, to tailor your plan to your specific needs.

- Choose the right policy term: Select a policy term that aligns with your financial goals and timeframe, whether it's a term life insurance for a specific period or a whole life insurance policy for lifelong coverage.

Future Outlook of Affordable Life Insurance for Retirees

Life insurance for retirees is likely to see significant changes in the coming years due to advancements in technology, evolving regulations, and emerging trends. These factors will play a crucial role in shaping the affordability and accessibility of life insurance plans for retirees.

Impact of Technological Advancements

With the rise of Insurtech companies and the use of data analytics, the process of underwriting and pricing life insurance policies is expected to become more streamlined and efficient. This could lead to insurers offering more tailored and affordable plans for retirees based on their health and lifestyle data.

Moreover, the integration of wearable technology and telemedicine services may further enhance the overall wellness programs associated with life insurance, potentially reducing premiums for retirees who actively monitor their health.

Regulatory Changes in the Insurance Industry

Changes in regulations can have a significant impact on the availability and cost of life insurance for retirees. As governments focus on consumer protection and transparency, there may be stricter guidelines for insurers to follow, ensuring fair pricing and comprehensive coverage options for retirees.

Additionally, regulatory reforms aimed at promoting competition and innovation in the insurance market could lead to the introduction of new affordable life insurance products tailored specifically for retirees.

Emerging Trends in the Life Insurance Sector

Emerging trends such as the growing popularity of hybrid life insurance products, like combination policies that offer both life insurance and long-term care benefits, could provide retirees with more versatile and cost-effective coverage options. Furthermore, the shift towards digital distribution channels and the increasing demand for sustainable and socially responsible investing may influence the development of affordable life insurance solutions that align with retirees' values and financial goals.

Ending Remarks

In conclusion, Affordable Life Insurance Plans for Retirees in 2025 offer a crucial safety net for financial stability during retirement. By understanding the evolving landscape of life insurance options, retirees can make informed decisions to safeguard their future. Stay informed, stay secure.

FAQ

What factors determine the cost of life insurance for retirees?

The cost of life insurance for retirees is influenced by factors such as age, health conditions, lifestyle choices, and the type of insurance plan chosen.

What are the benefits of guaranteed universal life insurance for retirees?

Guaranteed universal life insurance provides lifelong coverage with a guaranteed death benefit and flexible premium payments, making it a reliable option for retirees.

How can retirees customize their life insurance plans to suit their needs?

Retirees can customize their life insurance plans by selecting additional riders for specific coverage, adjusting coverage amounts, and choosing payment structures that align with their financial goals.