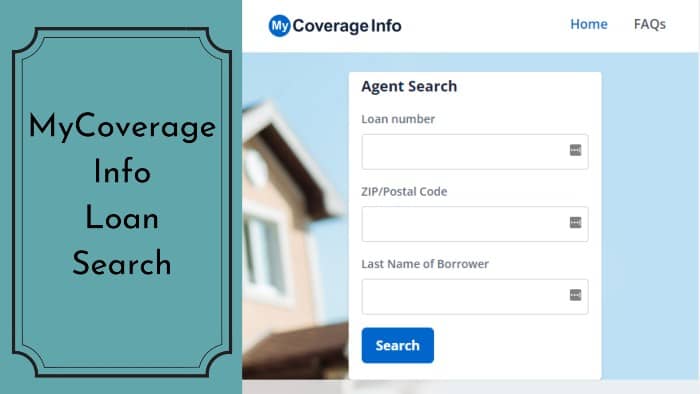

Exploring the world of insurance portals like MyCoverageInfo unveils a realm of convenience and efficiency in managing insurance matters. From streamlined processes to enhanced user experiences, these portals revolutionize how policyholders interact with their insurance policies. Let's delve into the intricacies of these digital platforms and unravel what makes them indispensable in today's insurance landscape.

Introduction to Insurance Portals like MyCoverageInfo

Insurance portals are online platforms that allow policyholders to access and manage their insurance policies digitally. These portals serve as a centralized hub for policy information, claims processing, and communication with insurance providers.

Functionality of Insurance Portals

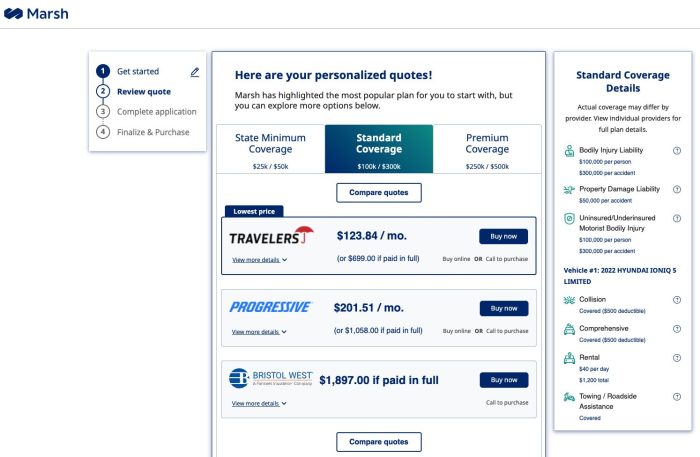

Insurance portals like MyCoverageInfo function by providing policyholders with convenient access to their insurance policies 24/7. Users can view policy details, make premium payments, file claims, and update personal information online.

Benefits of Using Online Insurance Portals

- Convenience: Policyholders can access their insurance information anytime, anywhere, without the need to visit physical offices.

- Efficiency: Online portals streamline processes such as claims filing and policy management, reducing paperwork and processing time.

- Transparency: Users can easily track their policy status, premium payments, and claims through real-time updates on the portal.

- Communication: Insurance portals facilitate direct communication between policyholders and insurance providers, ensuring quick responses to any queries or concerns.

Key Features of Insurance Portals

Insurance portals like MyCoverageInfo offer a range of features designed to make managing insurance policies more convenient and efficient for users. These features play a crucial role in enhancing the overall user experience and streamlining various insurance-related tasks.

Policy Management

- Viewing and managing insurance policies online

- Accessing policy details, coverage information, and premium payments

- Requesting policy changes, updates, or additions

Document Storage and Retrieval

- Securely storing important insurance documents digitally

- Accessing policy documents, ID cards, and claims forms anytime

- Downloading or printing necessary documents as needed

Claims Processing

- Filing and tracking insurance claims online

- Submitting claim documents and evidence digitally

- Receiving updates on claim status and processing

Communication Channels

- Direct messaging with insurance representatives

- Receiving alerts, notifications, and reminders related to policies

- Accessing FAQs, guides, and customer support resources

Mobile Accessibility

- Optimized portal interface for mobile devices

- Convenient access to insurance information on the go

- Mobile app integration for easy policy management

User Interface and Navigation

Insurance portals like MyCoverageInfo prioritize user-friendly design to enhance the overall user experience. The user interface plays a crucial role in ensuring that customers can easily access and manage their insurance information efficiently.

Ease of Navigation

- Clear and Intuitive Menus: Insurance portals often feature well-organized menus that allow users to navigate different sections easily.

- Search Functionality: Including a search bar enables users to quickly find specific information or services they are looking for.

- Interactive Dashboards: Visual representations of policy details and coverage summaries help users grasp information at a glance.

- Notification Alerts: Providing timely alerts and reminders regarding policy updates or payments can enhance user engagement.

User-Friendly Design Importance

- Enhanced User Experience: A well-designed interface can significantly improve the overall satisfaction of users interacting with the portal.

- Increased Engagement: Easy navigation and intuitive design elements encourage users to explore the portal further and utilize its functionalities.

- Reduced Errors: Cluttered or confusing interfaces can lead to user errors, whereas a user-friendly design minimizes such issues.

- Brand Perception: A visually appealing and user-friendly portal reflects positively on the insurance company's brand image.

Effective UI/UX Elements

- Responsive Design: Ensuring that the portal is accessible across various devices enhances user convenience.

- Personalization Options: Allowing users to customize their dashboard or settings can create a more personalized experience.

- Guided Onboarding: Providing step-by-step guidance for new users can help them understand the portal's features more easily.

- Feedback Mechanisms: Including options for users to provide feedback can help insurance companies improve their portal based on user preferences.

Security Measures and Data Protection

When it comes to insurance portals like MyCoverageInfo, ensuring the security and protection of user data is paramount. These platforms handle sensitive information such as personal details, policy documents, and financial data, making robust security measures a necessity to safeguard against cyber threats.

Encryption and Secure Connections

- Insurance portals like MyCoverageInfo utilize encryption technology to secure the transmission of data between users and the portal servers. This ensures that information exchanged is encrypted and protected from unauthorized access.

- Secure connections, such as HTTPS protocols, are implemented to establish a secure communication channel between the user's device and the portal's servers. This helps prevent data interception and tampering during online transactions.

Access Control and Authentication

- MyCoverageInfo employs strict access control mechanisms to regulate user permissions and restrict unauthorized access to sensitive data. Users are required to verify their identity through authentication processes such as passwords, PINs, or biometric verification.

- Multi-factor authentication adds an extra layer of security by requiring users to provide multiple forms of verification before accessing their accounts, reducing the risk of unauthorized access.

Compliance and Regulations

- Insurance portals like MyCoverageInfo adhere to data privacy regulations such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA) to ensure the protection of user data and compliance with legal requirements.

- Regular audits and security assessments are conducted to assess the portal's adherence to industry standards and identify any potential vulnerabilities that may jeopardize data security.

Comparison with Industry Standards

- MyCoverageInfo implements security protocols that align with industry standards such as ISO 27001 and PCI DSS to maintain a secure environment for online transactions and data storage.

- Continuous monitoring and updates to security measures are undertaken to address emerging threats and vulnerabilities, ensuring that user data remains protected against cyber attacks.

Customer Support and Assistance

Customer support is a crucial aspect of insurance portals like MyCoverageInfo, providing users with the necessary assistance and guidance they require when dealing with insurance-related queries and claims.

Available Support Options

- Live Chat: Many insurance portals offer live chat support to quickly address user inquiries and provide real-time assistance.

- Phone Support: Users can also reach out to customer support representatives via phone for personalized assistance.

- Email Support: For non-urgent matters, users can send emails to the support team and receive detailed responses to their queries.

Assistance with Insurance Queries and Claims

- Claim Status Updates: Users can easily check the status of their insurance claims on the portal, eliminating the need to contact customer support for updates.

- FAQ Section: Insurance portals often have a comprehensive FAQ section that addresses common queries and provides detailed information about insurance policies and procedures.

- Guided Claim Submission: Some portals offer step-by-step guidance on how to submit insurance claims correctly, reducing errors and speeding up the process.

Role of AI and Chatbots

AI-powered chatbots play a significant role in enhancing customer support services within insurance portals. These chatbots can:

- Provide Instant Responses: Chatbots can quickly respond to user queries and provide relevant information round the clock.

- Offer Personalized Recommendations: By analyzing user data, chatbots can offer personalized insurance recommendations based on individual needs and preferences.

- Assist with Claim Filing: Chatbots can guide users through the process of filing insurance claims, making it more efficient and user-friendly.

Integration with Insurance Carriers

Insurance portals like MyCoverageInfo play a crucial role in integrating with insurance carriers and third-party providers to streamline the insurance process for policyholders. This integration allows for seamless communication and sharing of information between all parties involved.

Benefits of Integration

- Efficiency: Integration with insurance carriers eliminates the need for manual data entry, reducing errors and speeding up the processing of policies and claims.

- Real-time Updates: Policyholders can receive instant updates on their coverage, premiums, and claims status through the portal, enhancing transparency and convenience.

- Personalized Services: With access to real-time data, insurance companies can tailor their services and offerings to meet the specific needs of policyholders.

Technology Behind Integrations

- APIs: Application Programming Interfaces (APIs) are used to facilitate the seamless exchange of data between insurance portals and carriers, ensuring compatibility and smooth communication.

- Data Encryption: Advanced encryption techniques are employed to protect sensitive information transmitted between the portal and insurance providers, safeguarding privacy and security.

- Data Analytics: Integration with insurance carriers enables the collection and analysis of data to identify trends, improve risk assessment, and enhance decision-making processes within the insurance ecosystem.

Personalization and Customization Options

Personalization and customization options are essential features offered by insurance portals like MyCoverageInfo. These features allow policyholders to tailor their insurance solutions according to their specific needs and preferences, enhancing their overall user experience.

Benefits of Personalization

- Customized Coverage: Policyholders can personalize their coverage options based on their individual requirements, ensuring they have the right level of protection.

- Personalized Recommendations: Insurance portals use data analytics to provide personalized recommendations for additional coverage or discounts, making the decision-making process easier for users.

- Flexible Payment Options: Users can choose payment schedules and methods that suit their financial situation, providing greater flexibility and convenience.

Mobile Accessibility and App Integration

In today's digital age, the ability to access insurance information on-the-go is becoming increasingly important. Let's explore how insurance portals like MyCoverageInfo ensure mobile accessibility and integrate with mobile apps for convenient insurance management.

Mobile Accessibility

- Insurance portals like MyCoverageInfo are designed to be mobile-responsive, allowing users to access their insurance information conveniently from any device, including smartphones and tablets.

- Users can easily log in to their accounts, view policy details, make payments, and submit claims directly from their mobile devices, eliminating the need for a desktop computer.

- Mobile accessibility ensures that users can manage their insurance needs anytime, anywhere, providing flexibility and convenience in today's fast-paced world.

App Integration

- Many insurance portals offer mobile apps that users can download to their smartphones for even quicker access to their insurance information.

- These apps often provide additional features such as push notifications for policy updates, easy claim submission with photo uploads, and instant access to customer support through live chat or call features.

- App integration with insurance portals enhances the user experience by streamlining the process of managing insurance policies and claims on-the-go.

Benefits of Mobile-Responsive Platforms

- Having a mobile-responsive platform for accessing insurance services offers users the flexibility to manage their policies and claims whenever and wherever they need to.

- Mobile accessibility ensures that users can stay informed about their coverage, make payments on time, and quickly report and track claims, enhancing overall customer satisfaction.

- With the integration of mobile apps, users can enjoy additional conveniences and features that make managing insurance easier and more efficient.

Last Recap

In conclusion, Insurance Portals Like MyCoverageInfo offer a gateway to simplified insurance management, personalized services, and enhanced customer support. Embracing these portals means embracing a future where insurance interactions are seamless, tailored, and user-centric. Stay informed, stay empowered, and let these portals redefine your insurance experience.

Q&A

How do insurance portals like MyCoverageInfo benefit policyholders?

Insurance portals offer policyholders easy access to their insurance information, streamlined processes for policy management, and enhanced customer support services.

What sets MyCoverageInfo apart from traditional insurance processes?

MyCoverageInfo stands out by providing a user-friendly interface, personalized services, and efficient integration with insurance carriers for seamless transactions.

How do insurance portals ensure data protection for users?

Insurance portals like MyCoverageInfo implement robust security measures, encryption protocols, and compliance with data privacy regulations to safeguard user data effectively.